Planning for retirement involves more than just saving money; it also requires knowing when and how to withdraw it. If you have a 401(k), IRA, or similar tax-advantaged retirement account, you’ll encounter Required Minimum Distributions, or RMDs. In this guide, we’ll explain RMDs, how they work for different accounts, and strategies to minimize their impact on your retirement income.

What are Required Minimum Distributions (RMDs)?

Required Minimum Distributions (RMDs) are the minimum amounts you must withdraw annually from your retirement accounts once you reach a certain age. The IRS mandates these withdrawals to ensure retirement savings are eventually taxed, as 401(k)s and Traditional IRAs grow tax-deferred.

Roth IRAs, however, do not require RMDs during the original account holder’s lifetime, making them unique among retirement accounts.

Why Do RMDs Exist?

RMDs ensure that retirement funds in tax-deferred accounts eventually generate tax revenue. These distributions prevent individuals from deferring taxes indefinitely and compel account holders to start using their retirement savings.

When Do RMDs Begin?

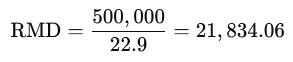

The age to start RMDs is generally 73 (as of 2024), though specific rules may vary:

- Traditional IRAs and 401(k)s: RMDs are required starting at age 73.

- Roth IRAs: No RMDs during the lifetime of the original account holder. This allows Roth IRA assets to continue growing tax-free, making Roth IRAs a valuable asset for those wanting tax-free income later or leaving an inheritance.

- Roth 401(k)s: RMDs are required at age 73, but you can roll the Roth 401(k) into a Roth IRA to avoid RMDs.

If you fail to take the required minimum distribution by the deadline, the IRS imposes a steep penalty. As of 2024, this penalty is 25% of the amount not withdrawn (down from the previous 50%).

How Are RMDs Calculated?

RMDs are calculated based on your account balance and life expectancy. Here’s how it works:

- Account Balance: The balance in your retirement account as of December 31 of the previous year.

- Life Expectancy Factor: The IRS provides a life expectancy factor, which is updated periodically and varies based on age. You can find these factors in the IRS Uniform Lifetime Table.

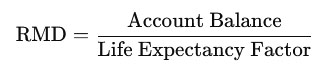

Formula:

To calculate your RMD, divide your account balance by your life expectancy factor:

Example Calculation:

Suppose you’re 75 years old with a Traditional IRA balance of $500,000, and your life expectancy factor is 22.9. Your RMD would be:

In this case, you’d need to withdraw $21,834.06 for the year to satisfy the RMD requirement.

RMDs for Different Accounts: 401(k) vs. IRA

Traditional IRA and RMDs

- RMDs are mandatory starting at age 73.

- Withdrawals are taxed as ordinary income, which may impact your tax bracket.

Roth IRA and RMDs

- No RMDs for the original account holder, allowing funds to grow tax-free indefinitely. However, beneficiaries who inherit Roth IRAs are subject to RMDs under the “10-Year Rule,” requiring them to withdraw all funds within 10 years.

401(k) and RMDs

- RMDs are required from a 401(k) starting at age 73, similar to a Traditional IRA.

- However, if you’re still employed by the company where you have a 401(k) and do not own more than 5% of the company, you may be able to defer RMDs until retirement.

Roth 401(k) and RMDs

- Roth 401(k) accounts are subject to RMDs at age 73, unlike Roth IRAs.

- To avoid RMDs, you can roll a Roth 401(k) into a Roth IRA before RMDs begin.

Strategies for Managing RMDs

Properly managing RMDs can help minimize taxes and optimize your retirement income. Here are a few strategies to consider:

1. Strategic Withdrawals Before Age 73

- If you’re in a lower tax bracket before RMDs begin, consider taking voluntary withdrawals. This can reduce the balance in your tax-deferred accounts, resulting in smaller RMDs once you reach age 73.

2. Convert to a Roth IRA

- Roth conversions allow you to transfer funds from a Traditional IRA or 401(k) to a Roth IRA. Although you’ll pay taxes on the conversion amount, future growth and withdrawals are tax-free, and you’ll avoid RMDs for the Roth IRA.

3. Consider Qualified Charitable Distributions (QCDs)

- If you’re 70 ½ or older, you can make a Qualified Charitable Distribution (QCD) directly from your IRA to a qualified charity. QCDs count toward your RMD and are excluded from taxable income, which can help reduce your tax liability.

4. Consolidate Multiple Accounts

- Managing multiple retirement accounts can complicate RMD calculations. Consolidating accounts may simplify RMDs and streamline withdrawals, although 401(k)s and IRAs must have RMDs taken from each account separately.

5. RMD-Friendly Investment Strategy

- To fund your RMDs, consider keeping a portion of your account in more liquid, conservative investments, such as bonds or cash equivalents. This helps reduce the need to sell off stocks or other volatile assets in a down market to meet RMD requirements.

6. Work with a Financial Advisor

- An advisor can help tailor a strategy for minimizing the tax impact of RMDs, such as optimizing the timing of withdrawals or recommending Roth conversions.

Impact of RMDs on Taxes

RMDs can significantly impact your tax situation in retirement:

- Ordinary Income Tax: RMDs are taxed as ordinary income, which could push you into a higher tax bracket.

- Social Security Taxation: If your income, including RMDs, exceeds certain thresholds, a portion of your Social Security benefits may become taxable.

- Medicare Premiums: High-income retirees face higher Medicare Part B and Part D premiums. If your RMDs increase your modified adjusted gross income (MAGI), you may be subject to these additional premiums.

Tax Strategy Tip: Working with a tax professional can help you navigate these potential tax impacts and create a withdrawal strategy that minimizes your tax burden.

Frequently Asked Questions about RMDs

Q: Can I take RMDs from one account to satisfy multiple accounts?

A: RMDs from IRAs can be combined, meaning you can take the total RMD from one IRA to satisfy all IRA RMDs. However, 401(k)s require RMDs from each individual account.

Q: What happens if I miss an RMD?

A: Missing an RMD results in a 25% excise tax on the amount not withdrawn. You may be able to request a waiver if the failure to withdraw was due to an error and you take corrective action promptly.

Q: Are RMDs required for inherited accounts?

A: Beneficiaries who inherit IRAs or 401(k)s are generally subject to RMDs and must withdraw all funds within 10 years (10-Year Rule) for accounts inherited after 2020.

Conclusion: Planning Ahead for RMDs

Understanding and planning for Required Minimum Distributions is a critical part of managing your retirement income. By taking proactive steps, you can minimize the tax impact of RMDs and maximize your income. Whether you’re considering Roth conversions, Qualified Charitable Distributions, or voluntary withdrawals, a well-thought-out strategy can help you navigate RMDs effectively.

Consulting with a financial advisor can provide personalized guidance, ensuring your retirement funds support a secure and comfortable retirement. With careful planning, you can approach RMDs confidently and optimize your retirement savings for the future.